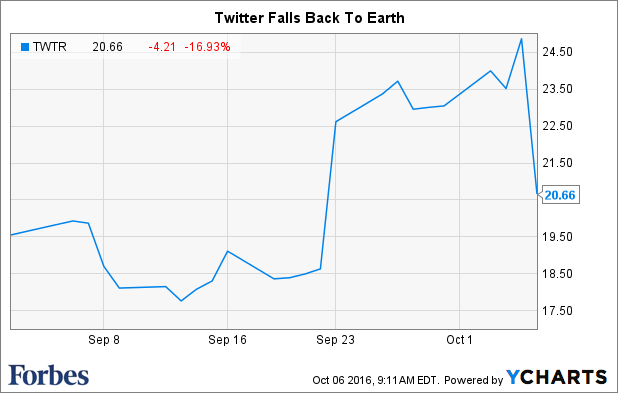

The social network’s shares, which rallied earlier in the week on reports that takeover bids were set to start rolling in, dropped 17% in pre-market trading on worries that some likely suitors aren’t so interested.

(Chris Ratcliffe/Bloomberg)

If Recode’s sources prove correct, it leaves Salesforce.com CRM +4.02% as perhaps Twitter’s last, best hope at wooing a suitor who will pay a premium for the business (a possibility that seems to be drawing the ire of Salesforce shareholders). Marc Benioff has been cagey about his company’s interest in the midst of its annual Dreamforce conference, but did tell Forbes’ Alex Konrad earlier this year that he knows exactly what he’d do to “fix” the company.

Recommended by Forbes

In conversations with FORBES this summer as part of reporting of the cover story for the September 13 issue, Benioff said of Twitter: “I know exactly what I would do.” Benioff’s vision of Twitter, he said in June, is to make the service more of a platform than an app. “I would make it a platform of the ‘now,’” he said.Source: Benioff Keeps Quiet About Twitter Bid But Previously Said ‘I Know Exactly What I Would Do’ To Fix ItTwitter shares closed at $24.87 Tuesday, and were poised to open below $21 a share Wednesday morning. The stock, which changed hands for $18.63 before the sale rumors escalated Sept. 23, had rallied 33% before the slide.

Aside from the apparent flight of many hoped-for bidders, Twitter’s potential exit has another big hurdle looming: the company is due to report its next quarterly earnings in exactly three weeks on Oct. 27.

source - http://www.forbes.com

Steve Schaefer

EmoticonEmoticon